unemployment tax break refund calculator

Unemployment Tax Break Refund How Much Will I Get. Tax Deductions and Tax Credits Explained Remember that a tax deduction reduces your taxable income cutting your tax bill indirectly by reducing the income thats subject to a marginal tax rate.

This is the latest round of refunds related to the added tax exemption for the first 10200 of unemployment benefits.

. The amount of the unemployment tax break depends on your filing status. How to calculate your unemployment benefits tax refund. In case you got any Tax Questions.

The Internal Revenue Service this week sent 430000 tax refunds averaging about 1189 to filers who paid too much in taxes for their 2020 unemployment benefits. This threshold applies to all filing statuses and it doesnt double to 300000 if you were married and file a joint return. The unemployment tax break is a special type of refund that allows you to deduct up to 20400 of unemployment benefits from your earnings.

Calculate Your EXACT Refund From the 10200 Unemployment Tax Break. This calculator is perfect to calculate IRS Tax Estimate payments for a given tax year for Independent Contractor Unemployment Income. A tax return calculator takes all this into account to show you whether you can expect a refund or not and give you an estimate of how much to expect.

Refund for unemployment tax break. The 10200 is the amount of income exclusion for single filers not the amount of the refund. Married couples filing jointly can deduct up to 30200 from their incomes.

A tax break isnt available on 2021 unemployment benefits unlike aid collected the prior year. The refunds totaled more than 510 million. Any unemployment compensation in excess of 10200 10200 per spouse if married filing jointly is taxable income.

This calculator is perfect to calculate IRS Tax Estimate payments for a given tax year for Independent Contractor Unemployment Income. The child tax credit checks began going out in july and will continue monthly through december for eligible families. This Estimator is integrated with a W-4 Form Tax withholding feature.

To qualify for this exclusion your tax year 2020 adjusted gross income AGI must be less than 150000.

How To Claim Unemployment Tax Exemption In 2021 Nextadvisor With Time

6 831 Irs Refund Photos Free Royalty Free Stock Photos From Dreamstime

When Can You File Taxes Where Is My Tax Refund Check Money

This The Average Tax Refund And How To Make The Most Out It

Unemployment Tax Refund How To Calculate How Much Will Be Returned As Usa

![]()

What To Know About Unemployment Refund Irs Payment Schedule More

Irs Sending Out More 10 200 Unemployment Tax Refund Checks Here S How To Track Your Payment The Us Sun

How To Estimate Your Tax Refund Lovetoknow

Irs Now Adjusting Tax Returns For 10 200 Unemployment Tax Break Forbes Advisor

Irs Now Adjusting Tax Returns For 10 200 Unemployment Tax Break Forbes Advisor

Check On Your Refund And Find Out Why The Irs Might Not Send It Beachfleischman Cpas

At Least 7 Million Americans In Line For Unemployment Tax Refunds

How To Get Your Stimulus And Tax Refund Fast Nextadvisor With Time

Average Tax Refund Up 11 In 2021

4 Steps From E File To Your Tax Refund The Turbotax Blog

Unemployment Tax Refund How To Calculate How Much Will Be Returned As Usa

Here S How To Get A Bigger Or Smaller Tax Refund Next Year

12 Reasons Why Your Tax Refund Is Late Or Missing

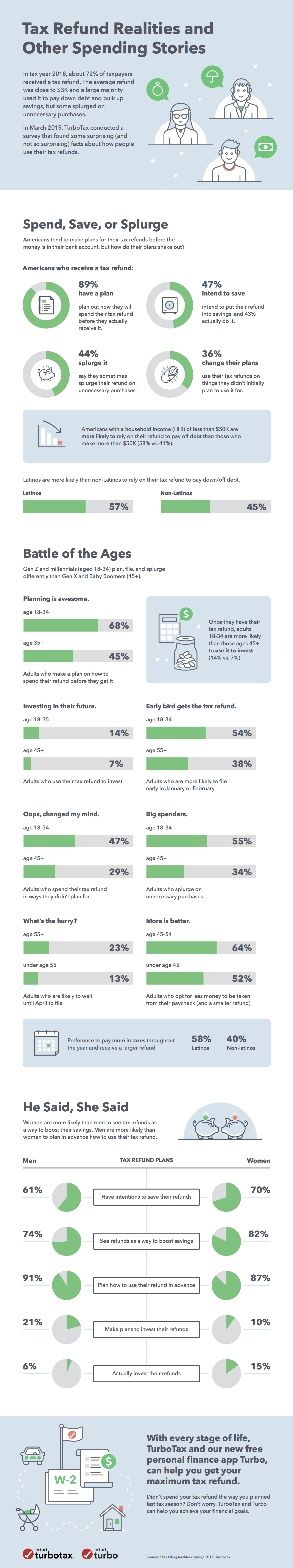

Tax Refund Realities And How Americans Spend And Save Their Tax Refunds Infographic The Turbotax Blog